When I graduated from the Naval Academy in 2007, there was a palpable feeling with regards to financial markets in the U.S.

No matter your level of financial knowledge, and trust me in 2007 mine was low, you knew something big was on the horizon. And in fact, the general public was right.

The events of the 2007-2009 time frame, added to the notoriety of Michael Lewis , after he published The Big Short, which detailed the underpinnings of what we were seeing play out each day. The economy was headed for a recession, financial markets were in turmoil, and housing prices were in the garbage.

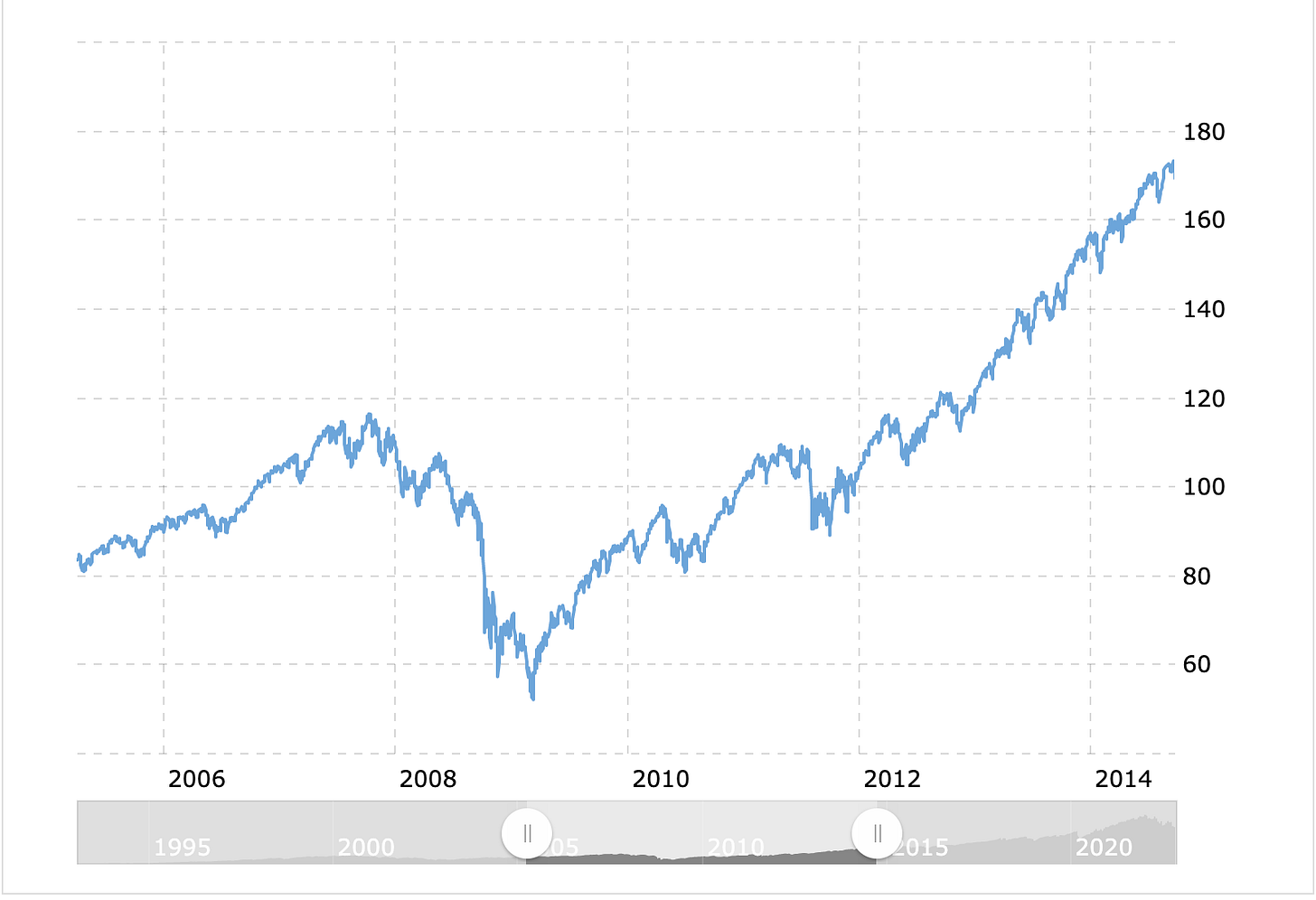

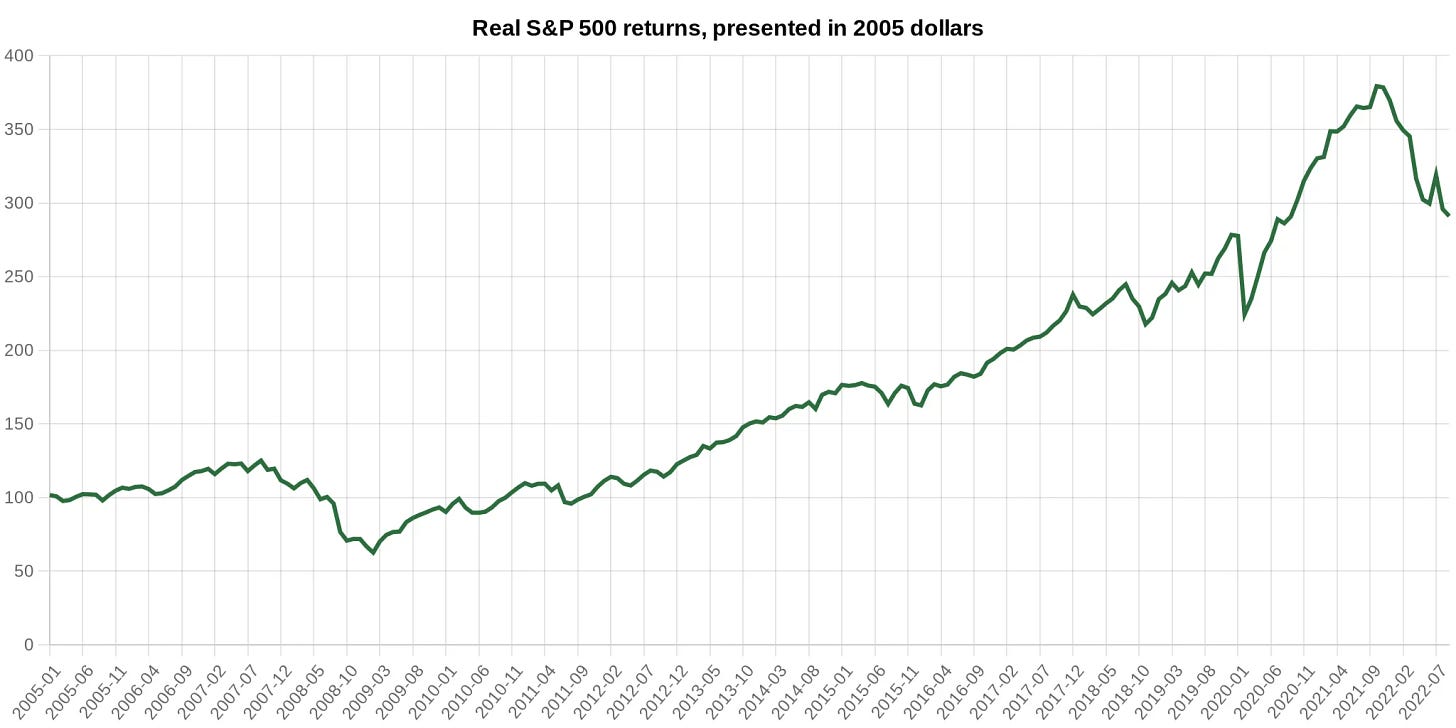

If you don’t believe me, look at the S&P 500 from 2005-2012 which did a complete round trip during that time. As a result we had to endure a lot of financial pain.

In fact at the worst point, $100 invested January 1, 2005, was worth roughly $62. Talk about painful.

Now 2005 is an important time for me. Its the year I started investing (involuntarily, lol). That precipitous decline in market performance was what led me on this financial journey.

Although, I didn’t need that money (at the time), that decline was painful to watch.

Hell, I guess you could say I am here because I felt shorted and I wanted to know what happened.

Shortly after graduating in 2007, the public began to talk more and more about a recession. Today, the word recession is a buzz word for financial types to gain some type of nerd street cred. Everyone wants to be the one to call it, but the National Bureau of Economic Research (NBER) is the ref when playing the economic game.

In fact per the NBER’s, “Business Cycle Dating Committee aka The Ref, a recession is defined as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

Make no mistake in 2007 to 2010 ish we were in a recession.

The question is why am I talking about a recession, when this post is about housing prices? That’s a great question and the answer is they are related.

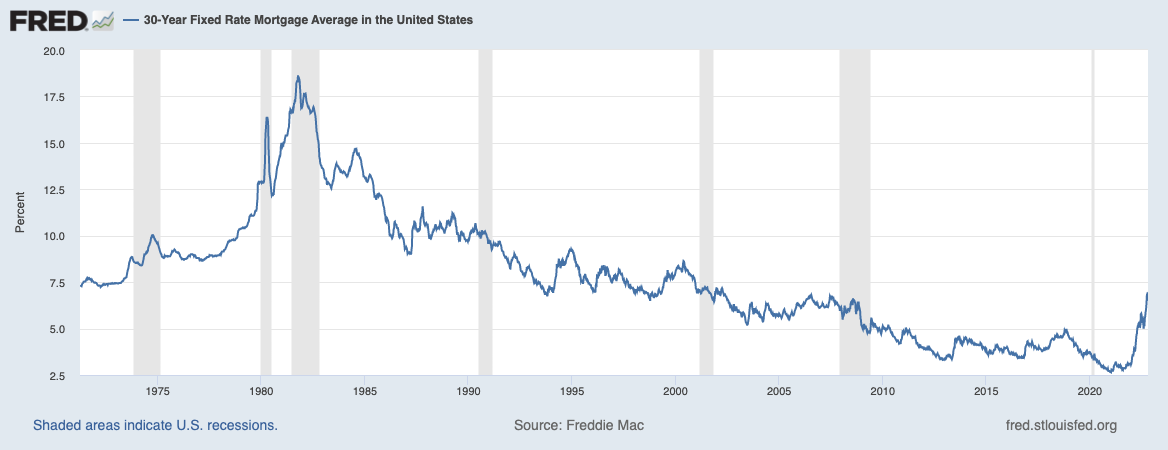

But before we can talk about housing prices, we need to look at mortgage rates. Roughly 2/3rd of Americans use a mortgage to purchase a home. As a geriatric millennial (heavy emphasis on the geriatric), my adult years have largely been in a low mortgage rate environment.

The reality is low mortgage rates are abnormal and we need to acknowledge that.

If you’re interpreting the above graph correctly, you’ll see that the normal average mortgage rate should between 6 & 7 percent.

Where are we today?

Well according to the St. Louis FED, we are around 6.94% on average for a 30 year fixed mortgage.

Another way of saying this, is that we are back to the mean. So for everyone freaking out about mortgage rates, I say this.

Stop.

These are normal historical rates based upon the average and we had the privilege of being born at the right time to experience abnormally depressed rates.

Now, back to housing prices.

Well that same chart from the FED shows something interesting, rates were going up in 2007 and then took roughly 5 years to decline.

Now with that being said, how the did housing prices respond in the U.S.?

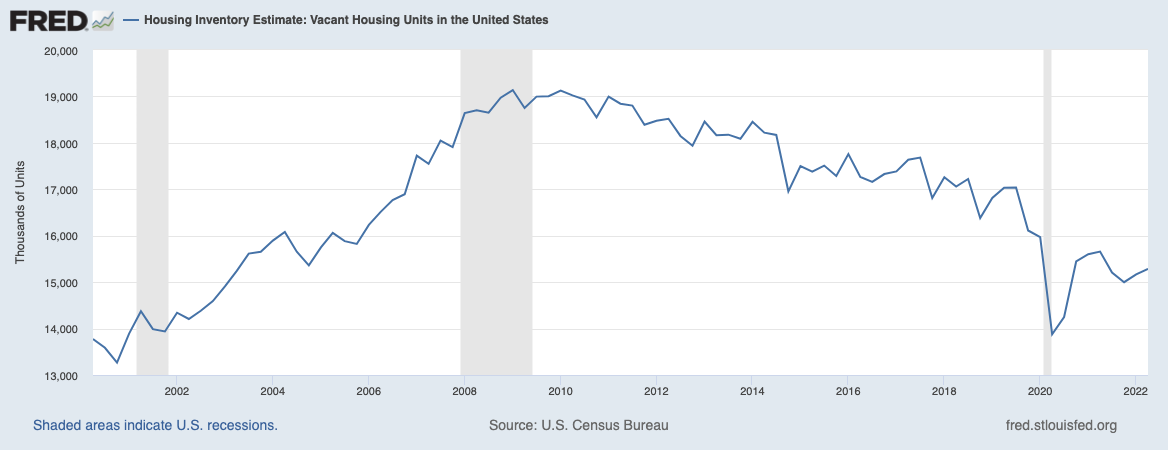

Before we answer that, we also need to look at housing inventory over the years, because we know supply and demand hep determine price. No use having low interest rates if there are no homes available to purchase.

So we see based on data from the St. Louis Fed, we had a high number of vacant homes in the 2007 - 2010 range right at the time the stock market tanked. The response to this was to lower rates, which made money cheaper to borrow and led to less inventory being available.

So over that same period of time, home prices dropped and then slowly recovered.

Now fast forward to today, where we have high mortgage rates, low inventory, and high home prices. So whats going on?

Economics suggests that low supply with stable or increasing demand should be followed by increase in prices. Right now we have low supply and high home prices. So, we have to be missing something.

Well, first thing we are missing is the fact that mortgage rates can have a great effect on demand. As stated above 2/3rds of Americans use a mortgage to purchase a home. If mortgage rates are prohibitive from purchasing at the current housing prices, then we should in theory see less demand.

According to tradingeconomics.com, the Mortgage Bankers Association of America, reported that mortgage applications in the US fell 4.5% in the week ending October 14th, a fourth consecutive decline as the 30-year mortgage rate hit 6.94% for the first time since 2002.

So if a decrease in mortgage applications signals a decrease in demand, even with less supply, housing prices have to come down soon right?

Well, it depends upon how you define “soon.”

I asked this question to Logan Mohtashami who is the Housing Market God/Guru/Shaman on Twitter (@loganmohtashami).

Per Mr. Mohtashami, it should take 2 years of weak demand to start to see a decrease.

However, millennials are now the largest population in the U.S. and are in their peak earning years. It’s easy to surmise that they are going to have growing families and lifestyles which should signal a need for starting/building a place to call home.

So, I’m left with the question, is demand going to decrease enough in the housing market to see a decline in prices?

After looking at everything, I am not so sure. I am more inclined to think that people are going to suck up a “high” mortgage rate and buy anyway.

I assume price decreases would depend on whether the number of sellers exceeds the number of buyers. In a new construction community, the builder has to sell all the houses right away, so prices will decrease a lot to attract marginally interested buyers.

Conversely, in a well-established community in a good school district where there are many upper middle class resident homeowners and few investors, there may be many potential buyers and few sellers. In that case, the buyers will have to "suck up the high mortgage rate" to get into that community.

Also, when deciding whether the mortgage rate is low or high, one should consider payment/income, not the rate by itself. At current rates, prices, and incomes, the payment/income is likely at a historic high point, even if interest rates are historically average. Thus, prices would have to significantly decrease in order for affordability to be "average."

nice coverage, thank you, keep it rocking, cheers!

P.S. complementary, we should see some pressure on the short-term https://mobile.twitter.com/Maverick_Equity/status/1597221472992649216